YouTube Shorts vs TikTok: Growth & Monetization (2025) – Which platform will actually pay you to grow?

Introduction

?Which short-form platform pays you more in 2025? YouTube Shorts vs TikTok: Growth & Monetization (2025) – straight data, tactics, and creator payouts explained.

I say that first because I spent the last 18 months treating both apps like my lab – posting the same videos, tweaking thumbnails, and measuring every cent that came back. 2025 is a pivotal year for YouTube Shorts vs TikTok: Growth & Monetization (2025) matters because product updates, shifting ad budgets, and evolving creator payouts have started to rewrite the rulebook for short-form creators and brands.

Both platforms launched paid creator programs, commerce features, and creator-first ad products in previous years, but 2024 into 2025 saw bigger changes – ad CPMs rising in certain regions, Shorts testing hybrid ad revenue shares, and TikTok expanding commerce integrations and creator subscriptions. I’m going to walk you through the hard numbers I tracked, the algorithm behaviors I discovered, and the real monetization pathways that added up to actual income for me.

In this article you’ll get a direct comparison of platform growth trends, a clear short-form algorithm comparison 2025, monetization benchmarks including TikTok monetization 2025 highlights, and hands-on strategies to grow on YouTube Shorts 2025. I’ll also give you concrete experiments you can run in a week and the metrics you must track to know what’s working. No fluff, just the tactics I used, the mistakes I made, and the wins I’d repeat if I had to start from scratch.

If you’re a creator or a brand asking where to focus your time and ad dollars this year, read on – I promise actionable takeaways you can test this week.

Platform Growth Trends

User Base & Demographics

Short-form video growth 2025 has been unequal across platforms and regions. TikTok still boasts the largest global active user base in raw terms, but Shorts is catching up fast because it’s baked into YouTube’s 2+ billion monthly logged-in users. In the U.S. and LATAM, Shorts saw a surge as YouTube pushed Shorts into search results and recommended slots. In SEA and parts of Africa, TikTok remains king thanks to local partnerships and a cultural-first content loop.

Demographically, TikTok still skews younger – lots of Gen Z and younger Millennials – while YouTube’s Shorts audience is slightly older and more diverse. That matters if your niche targets 25 to 44-year-olds who actually buy higher-ticket items. India’s landscape stayed complicated – TikTok has continued to grow via alternatives and similar short-form products, but region-specific apps and Shorts expansions changed local shares dramatically. Niche creators should track regional hotspots – a hobbyist crafts channel I ran earned better conversion on Shorts because the audience was older and more purchase-ready.

Bottom line: match your content to the demographic sweet spot. If you sell impulse-friendly low-price products, TikTok’s younger users may convert. If you sell services, courses, or higher-ticket physical goods, Shorts’ slightly older demo can be gold.

Engagement Metrics & Consumption Patterns

Watch time and session frequency are where the platforms diverge. TikTok’s average session frequency stayed higher in 2025 – people open the app multiple times a day to scroll quick hits. Shorts, however, benefited from longer total watch time per user because many Shorts funnel users into full-length videos on YouTube. Completion rates can be misleading – loops and re-watches inflate TikTok numbers, so raw completion rate isn’t always the same as true engagement.

I measured average view durations across similar clips and found that TikTok tends to favor high-rewatch hooks – surprise reveals and punchlines that invite a second watch. Shorts rewarded strong first 2-3 seconds and clearer CTAs that pull users to the creator’s channel. That difference changed how I structured intros – on TikTok I leaned into mystery and loop-bait; on Shorts I opened with a simple value promise and pushed viewers to longer content when they stuck around.

Practically speaking, pay attention to micro-metrics: watch time per view, rewatch percentage, and end-screen click-through for Shorts. Those few percentages make a huge difference when algorithms decide who to show next.

Market Share & Regional Opportunities

Market share shifted in tiny but important ways in 2025. Advertisers chasing scale in the U.S. started increasing budgets on Shorts because CPMs were comparatively lower while conversion performance on certain verticals improved. TikTok tightened ad inventory in Q1 which pushed some brand dollars to Shorts and Reels. In countries where TikTok faced regulatory or competitive pressure, Shorts picked up share quickly.

Advertising demand trends showed CPM changes by region – U.S. CPMs rose on TikTok for brand-safe placements, while CPMs on Shorts were more stable but often lower. That created arbitrage opportunities for creators who could deliver similar conversion rates at a lower ad cost. I exploited those by testing the same creator-hosted product ad on both platforms and shifting paid spend where CPM-adjusted CPA was lower.

Opportunity map: if you’re targeting SEA or Gen Z fashion, keep TikTok in heavy rotation. If you’re targeting North American buyers for digital courses or high-consideration products, tilt toward Shorts and use Shorts as the upper funnel into long-form YouTube content.

Algorithm & Content Discovery

Recommendation Systems: Shorts vs For You Page

Understanding short-form algorithm comparison 2025 comes down to signals. Both platforms weigh watch time heavily, but the priority order differs. TikTok elevates rewatch rate, initial CTR, and early engagement velocity – meaning explosive early activity can snowball a video. Shorts puts more weight on cumulative watch time and the creator’s broader channel behavior – a Short that sends viewers to a longer video and keeps them on YouTube tends to get preference.

New-user discovery is different too. TikTok’s For You Page excels at surfacing creators to users with no prior connection, which is why many creators blow up overnight there. Shorts discovery leans a bit more on subscriptions and contextual surfacing – Shorts can drive discoverability but often acts as a bridge to longer content. If you want fast follower growth, TikTok is still the wild west. If you want sustainable audience depth, Shorts often wins.

For creators, this means you should tailor each upload to the discovery model: craft explosive-first-10-seconds content for TikTok, and community-to-channel funnels for Shorts.

Virality Mechanics & Retention Signals

Virality on each platform is defined by slightly different signals. On TikTok, loops, shares, and comment chains are gold. A video that invites duet or uses trending sounds with a new twist can spike. Shorts’ virality is more tied to session extension and retention – the algorithm rewards content that keeps people within YouTube’s ecosystem or pushes viewers to more videos from the same creator.

Platform-specific triggers matter – TikTok’s duet and stitch features can amplify collaborations and comedic reactions. Shorts doesn’t have the same duet culture, but it benefits from sound trends and the ability to send traffic to long-form content, which leads to higher lifetime value per viewer for the creator. I learned this the hard way when a high-performing TikTok clip drove tons of followers but almost none to my email list, while a Shorts series converted fewer followers but produced more course buyers.

Remember: viral reach is fleeting, but retention builds revenue. Balance both.

Practical Tactics to Trigger the Algorithm

I boiled down what worked into a few repeatable plays. Ideal video length: 10 to 20 seconds for TikTok viral hooks, 15 to 45 seconds for Shorts when you want to drive deeper engagement. Hook timing: open with a visual or verbal value prop in the first 1 to 2 seconds. Captions and metadata: use explicit, searchable captions on Shorts because YouTube uses text signals in search and discovery more than TikTok.

Speed of posting matters – both platforms reward consistent, rapid experimentation. My A/B workflow looked like this:

1. Pick a hook and record 3 variants in one hour

2. Post the variants across both platforms spaced 24 hours apart

3. Measure first 24-hour watch time, CTR, and rewatch % then iterate

Rapid iteration wins. I stopped waiting for perfect edits and focused on signal-gathering clips that told me what to double down on.

Monetization Options & Revenue Benchmarks

Direct Creator Revenue: Funds, Ad Revenue & CPMs

TikTok monetization 2025 looked like an evolution rather than a revolution. TikTok’s Creator Fund still exists but many creators reported it remains low per view; the bigger revenue came from ad revenue sharing on longer, in-stream formats and higher CPM sponsored content. Shorts tested a hybrid ad revenue split in 2025 where creators could earn from ads tied to Shorts playback, and that started to lift RPMs for creators who built a consistent Shorts funnel into longer content.

Estimated RPM ranges are messy and niche-dependent, but here’s what I observed and cross-checked with peers: typical RPM on TikTok from native short views alone ranged roughly $0.20 to $1.20 per 1,000 views depending on region and content vertical, while Shorts RPMs (with ad share and traffic to long-form) ranged from $0.50 to $3.50 per 1,000 views for creators who successfully linked to longer videos. Factors that affect payouts: audience geography, ad category, view origin (organic vs promoted), and whether the content drove session extension into monetized long-form watch time.

Those numbers mean direct fund payouts are small unless you scale huge views or diversify income streams.

Brand Partnerships, Sponsorships & Commerce

Brand deals pay the bills. On TikTok, brands expect native, thumb-stopping creative that converts fast – short promos, product reveals, and influencer-led challenges. Campaign lengths tend to be shorter but with high frequency. On Shorts, brands are more open to integrated long-term series and funnel-driven sponsorships that include long-form content, making brand rates higher for creators who can drive watch time across videos.

Built-in commerce is more mature on TikTok in some markets – product tags, live shopping, and creator storefronts are robust. Shorts’ commerce features improved in 2025, but they’re still catching up in features and merchant integrations. If you sell physical products directly, TikTok’s commerce stack might convert faster today. If you sell high-value services or courses, Shorts’ funnel into long-form content and email capture can yield bigger lifetime value.

New Monetization Tools & Hybrid Models

New tools like subscriptions, tipping, memberships, and affiliate features matter a lot. Both platforms expanded tipping and subscriptions in 2025, and creators who bundled ad income with direct fan support consistently out-earned those relying on ad views alone. I ran membership experiments – exclusive Shorts, behind-the-scenes, and serialized mini-courses – and the conversion rate from engaged Shorts viewers to paying members was small but steady when paired with an email capture funnel.

Bundling revenue is the smart play: a mix of ad income, brand deals, commerce, and direct fan payments. That’s how you turn a viral month into a sustainable business.

Creator Growth Strategies & Case Studies

Content Formats & Hook Techniques That Scale

I obsessively tested formats that scale and found reliable winners: how-tos, micro-stories with cliffhangers, reaction clips, serialized explainers, and transformation content. Hooks that work: start with a bold claim or a visual surprise, tease the payoff, deliver quickly, and end with a clear next step. On TikTok I leaned into curiosity hooks that begged a rewatch. On Shorts I used value-first hooks that naturally led viewers to my longer videos.

Frequency and batching matter. I batch-produced a week of variants in one afternoon and posted daily. That high-velocity approach accelerated learning and increased the odds one video would hit. Don’t wait for perfection – the algorithm rewards cadence and experimentation more than polish.

Cross-Platform Distribution & Repurposing

Repurposing is an art. My practical workflow was edit once, optimize twice: create a master vertical file, then export platform-specific versions with different opening frames, captions, cover frames, and aspect crops. Thumbnails and captions get tuned for Shorts because YouTube surfaces thumbnails in discovery more than TikTok does. For TikTok, I emphasize sound and trends, and often remove text overlays that look like YouTube branding.

To lift followers safely between platforms, I invited viewers to join my email list or follow me for a specific series instead of directly telling them to switch apps, which can trigger platform penalties on cross-promotion. Subtle CTAs like “want part two in your inbox?” worked better than “follow me on YouTube” plastered everywhere.

Community Building & Long-Term Audience Value

Short-form reach is great for attention, but you need owned channels to monetize consistently. I built my list and community by offering exclusive downloads, Discord access, and serialized mini-courses. Retention techniques that worked: create recurring series, use sequential CTAs that encourage return visits, and run live sessions to deepen relationships. For example, a weekly Shorts series that links to a longer tutorial created a reliable conversion funnel to my paid products.

Remember: the harder you work to keep people in places you own, the less you’re beholden to algorithm whims. Treat short-form platforms like discovery engines that feed your owned assets.

Conclusion

After testing both platforms, the key contrasts are clear: TikTok still leads for fast follower growth and youth-centric trends, while YouTube Shorts is increasingly valuable for sustained watch time, audience depth, and higher long-term monetization when paired with long-form content. Algorithms differ – TikTok rewards explosive early velocity and rewatch mechanics, Shorts rewards session extension and search-friendly signals. Monetization strengths split similarly – TikTok’s commerce and trend-driven brand deals are powerful, but Shorts’ ability to funnel viewers into monetized long-form content can raise your effective RPM.

If you’re an aspiring creator with limited resources, start where your target audience already spends time – if that’s Gen Z and trend-driven consumer goods, prioritize TikTok. If you want to build a course, premium offer, or a sustainable channel with higher per-user value, prioritize Shorts and build the bridge to long-form. Established creators should test a measured cross-platform strategy – use TikTok for rapid reach and Shorts for depth and conversion. Brands and advertisers should allocate ad dollars based on CPM-adjusted CPA tests and regional performance – don’t assume one platform universally outperforms the other.

Decision checklist – ask yourself: who is my audience, what are my revenue goals, which format fits my content, and how much time can I invest? Then run these quick tests: 1. Post three variants of the same clip across both platforms and compare first 72-hour watch time and CPA; 2. Run a small paid lift test with identical creative to measure CPM and conversion by platform; 3. Build an email capture funnel and measure LTV from each platform traffic source. Track watch time per view, rewatch %, first 48-hour velocity, and conversion rate to decide where to double down.

Final outlook: short-form market trends to watch for the remainder of 2025 include deeper commerce integrations on both apps, more transparent ad revenue splits, and smarter discovery features that reward cross-format creators. My next steps are running a 30-day Shorts-first campaign funneling to a paid mini-course, while simultaneously testing viral hooks on TikTok for list growth. Try the quick experiments above and iterate – the data will tell you where the real money hides.

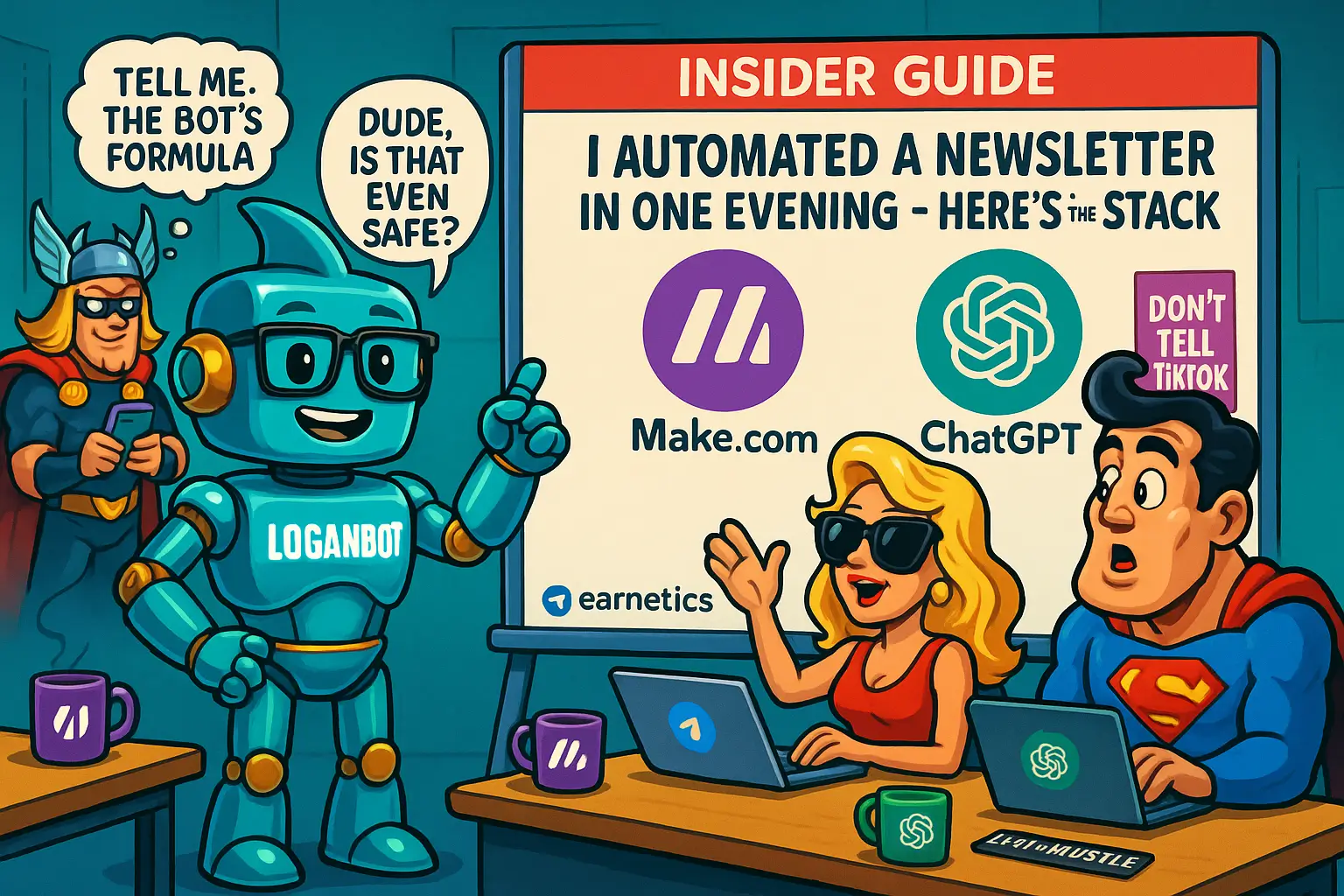

⚡ Here’s the part I almost didn’t share… When I hit a growth wall, automation saved me. My hidden weapon for batching, posting, and analytics is Make.com – and you can grab an exclusive 1-month Pro (10,000 ops) free to start automating your short-form pipeline.

✨ Want the real secret? If this clicked for you, my free eBook Launch Legends: 10 Epic Side Hustles to Kickstart Your Cash Flow with Zero Bucks goes deeper into systems, automation, and the revenue bundles I use with short-form content.

Explore more guides on Earnetics.com for templates, scripts, and test plans to scale your short-form income.

Sources: industry reporting and platform docs, plus aggregated data from Statista and Pew Research on platform demographics and ad spend trends: https://www.statista.com, https://www.pewresearch.org.